###-Book Description Begin-###

-------如果这里没有任何信息,不是真没有,是我们懒!请复制书名上amazon搜索书籍信息。-------

###-Book Description Begin-###

by Rod Caldwell (Author)

Simplify tax and save money with streamlined bookkeeping

Small businesses are often just that—small. Bookkeeping may be done by a professional outside the company, but more often falls to an employee or the business owner, who may or may not be well-schooled in the intricacies of tax law and business regulations. Tax time can end up costing small businesses a fortune in either professional fees or missed deductions every year. What if you could simplify the process and save money?

Taxation for Australian Businesses: Understanding Australian Business Taxation Concessions is the ultimate guide to tax for the small business owner. Author Rod Caldwell, 20-year veteran of the Australian Taxation Office, leads you through the process of managing your books and keeping more straightforward records to simplify the process of filing tax. The introduction of the GST and the new tax system involves a lot of new work for business owners, but Taxation for Australian Businesses eases the way by explaining the intricacies of applicable tax law, fully updated to parallel the May 2014 budget. Topics include:

Business structures, accounting systems, and cash accounting

FBT, private versus domestic use, and when to record a payment

Motor vehicles, the GST, and depreciation

Owners salary, end of period processing, and how to account for stock trading

The book explains everything you need to know and ties it all together to show you how to put the information into practice. No jargon, no textbooks, just common sense and reason. If you would like to get your bookkeeping straightened out and get back to your business, Taxation for Australian Businesses: Understanding Australian Business Taxation Concessions is the one guide that will get you there quickly.

###-Book Description End-###

###-Book Description End-###

1、本站所有分享材料(数据、资料)均为网友上传,如有侵犯您的任何权利,请您第一时间通过微信(lib99net)、QQ(24661067)、电话(17898078618)联系本站,本站将在24小时内回复您的诉求!谢谢!

2、本站所有商品,除特殊说明外,均为(电子版)Ebook,请购买分享内容前请务必注意。特殊商品有说明实物的,按照说明为准。

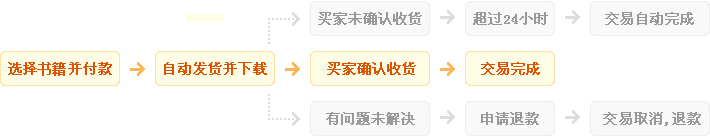

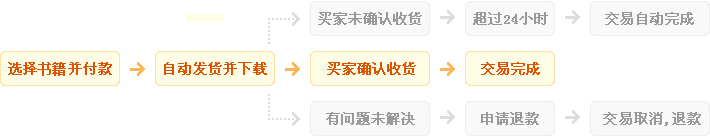

1、自动:在上方保障服务中标有自动发货的宝贝,拍下后,将会自动收到来自卖家的宝贝获取(下载)链接;

2、手动:未标有自动发货的的宝贝,拍下后,卖家会收到邮件、短信提醒,也可通过QQ或订单中的电话联系对方。

1、描述:书籍描述(含标题)与实际不一致的(例:描述PDF,实际为epub、缺页少页、版本不符等);

2、链接:部分图书会给出链接,直接链接到官网或者其他站点,以便于提示,如与给出不符等;

3、发货:手动发货书籍,在卖家未发货前,已申请退款的;

4、其他:如质量方面的硬性常规问题等。

注:经核实符合上述任一,均支持退款,但卖家予以积极解决问题则除外。交易中的商品,卖家无法对描述进行修改!

1、在未购买下前,双方在QQ上所商定的内容,亦可成为纠纷评判依据(商定与描述冲突时,商定为准);

2、在宝贝同时有网站演示与图片演示,且站演与图演不一致时,默认按图演作为纠纷评判依据(特别声明或有商定除外);

3、在没有"无任何正当退款依据"的前提下,写有"一旦售出,概不支持退款"等类似的声明,视为无效声明;

4、虽然交易产生纠纷的几率很小,但请尽量保留如聊天记录这样的重要信息,以防产生纠纷时便于网站工作人员介入快速处理。

![]()

![]()

![]()

![]()

![]()

人工在线查找书籍,不要问我们有什么,告诉我们您需要什么即可...¥1.00

人工在线查找书籍,不要问我们有什么,告诉我们您需要什么即可...¥1.00 【PPT】Linear Algebra and Its Applica...¥0.1

【PPT】Linear Algebra and Its Applica...¥0.1 Delay-Adaptive Linear Control by Ya...¥29.99

Delay-Adaptive Linear Control by Ya...¥29.99 Handbook of Organic Materials for E...¥19.99

Handbook of Organic Materials for E...¥19.99 FinFET Devices for VLSI Circuits an...¥29.99

FinFET Devices for VLSI Circuits an...¥29.99 Positron Beams and Their Applications¥29.99

Positron Beams and Their Applications¥29.99 ASM Handbook Volume 11A Analysis an...¥420.00

ASM Handbook Volume 11A Analysis an...¥420.00 PETSc for Partial Differential Equa...¥29.99

PETSc for Partial Differential Equa...¥29.99 无机非金属材料热工设备-作 者 : 姜洪舟主编 2015第5版...¥14.99

无机非金属材料热工设备-作 者 : 姜洪舟主编 2015第5版...¥14.99 Product and Process Design Principl...¥9.99

Product and Process Design Principl...¥9.99