by

Master today's tax concepts and current tax law with SOUTH-WESTERN FEDERAL TAXATION 2022: ESSENTIALS OF TAXATION: INDIVIDUALS AND BUSINESS ENTITIES, 25E and accompanying professional tax software. This concise guide focuses on the most recent tax laws impacting individuals, corporations, partnerships, estates, trusts and financial statements. Updates emphasize the latest tax changes and 2021 developments, including coverage of the Tax Cuts and Jobs Act of 2017 with guidance from the treasury department. Recent examples, updated summaries and tax scenarios clarify concepts and sharpen critical-thinking, writing and research skills, while sample questions from Becker C.P.A. Review assist in study. Each new book includes access to Intuit ProConnect tax software, Checkpoint (Student Edition) from Thomson Reuters and CNOWv2 online homework tools. Use these resources to prepare for professional exams or to begin study for a career in tax accounting, financial reporting or auditing.

Annette Nellen, C.P.A., C.G.M.A., Esq., directs San Jose State University�s graduate tax program (M.S.T.) and teaches courses in tax research, tax fundamentals, accounting methods, property transactions, employment tax, ethics, and tax policy. Professor Nellen is a graduate of CSU Northridge, Pepperdine (MBA) and Loyola Law School. Prior to joining San Jose State University (SJSU) in 1990, she worked with a Big Four firm and the IRS. At SJSU, Professor Nellen was recognized with the Outstanding Professor and Distinguished Service awards. She is an active member of the tax sections of the AICPA, American Bar Association and California Lawyers Association. She chaired the AICPA Tax Executive Committee from October 2016 to May 2019. In 2013, she received the AICPA Arthur J. Dixon Memorial Award -- the highest award given by the accounting profession in the area of taxation. Professor Nellen is the author of Bloomberg Tax Portfolio, Amortization of Intangibles. She has published numerous articles in the AICPA Tax Insider, The Tax Adviser, State Tax Notes and The Journal of Accountancy. She has testified before the House Ways and Means and Senate Finance Committees and other committees on federal and state tax reform. Professor Nellen maintains the 21st Century Taxation website and blog (www.21stcenturytaxation.com) as well as websites on tax reform and state tax issues (www.sjsu.edu/people/annette.nellen/).

Andrew D. Cuccia, Ph.D., C.P.A., is the Steed Professor of Accounting at the University of Oklahoma. He earned his Bachelor of Business Administration from Loyola University, New Orleans, and his doctorate from the University of Florida. Prior to entering academia, Dr. Cuccia practiced as a C.P.A. at a Big Four accounting firm. Before joining the University of Oklahoma, he served on the faculties at Louisiana State University and the University of Illinois. His research focuses on taxpayer and tax professional judgment and decision making and has been published in several journals, including The Accounting Review, Journal of Accounting Research, The Journal of the American Taxation Association, The Journal of Economic Psychology, and Tax Notes. He has taught undergraduate and graduate courses in income tax fundamentals as well as graduate courses in corporate tax, tax policy and tax research. Dr. Cuccia is a past president of the American Taxation Association and is a member of the American Accounting Association and the AICPA.

Mark B. Persellin, Ph.D., C.P.A., C.F.P., is the Ray and Dorothy Berend Professor of Accounting at St. Mary�s University. He earned his bachelor�s degree from the University of Arizona, his Master of Public Administration in taxation from the University of Texas at Austin and his doctorate from the University of Houston. Today, Dr. Persellin teaches personal income tax, business income tax and research in federal taxation. Prior to joining St. Mary�s University, Dr. Persellin taught at Florida Atlantic University and Southwest Texas University (Texas State University). He also worked on the tax staff of a Big Four firm. Dr. Persellin's research has been published in numerous academic and professional journals, including The Journal of American Taxation Association, The Accounting Educators� Journal, The Tax Adviser, The CPA Journal, Journal of Taxation, Corporate Taxation, The Tax Executive, TAXES - The Tax Magazine, Journal of International Taxation, and Practical Tax Strategies. In 2003, Dr. Persellin established the St. Mary�s University Volunteer Income Tax Assistance (VITA) site, and he continues to serve as a trainer and reviewer for the site.

James C. Young, Ph.D., C.P.A., is the PricewaterhouseCoopers Professor of Accountancy at Northern Illinois University. He earned his bachelor of science from Ferris State University and his MBA and doctorate from Michigan State University. Dr. Young's research, using archival data, focuses on taxpayer responses to the income tax. His dissertation received the PricewaterhouseCoopers/American Taxation Association Dissertation Award and his subsequent research has received funding from a number of organizations, including the Ernst & Young Foundation Tax Research Grant Program. His work has been published in a variety of academic and professional journals, including the National Tax Journal, The Journal of the American Taxation Association and Tax Notes. Honored as a Northern Illinois University Distinguished Professor, Dr. Young received the Illinois C.P.A. Society Outstanding Accounting Educator Award in 2012. In addition, he has received numerous university teaching awards from Northern Illinois University, George Mason University and Michigan State University.

David M. Maloney, Ph.D., C.P.A., is the Carman G. Blough Professor of Accounting Emeritus at the University of Virginia�s McIntire School of Commerce. He completed his undergraduate work at the University of Richmond and his graduate work at the University of Illinois at Urbana-Champaign. Upon joining the University of Virginia faculty, Dr. Maloney taught federal taxation in the graduate and undergraduate programs and was a recipient of major research grants from the Ernst & Young and KPMG Foundations. Dr. Maloney has published work in numerous professional journals, including Journal of Taxation, The Tax Adviser, Tax Notes, Corporate Taxation, Accounting Horizons, Journal of Taxation of Investments and Journal of Accountancy.

Publisher : Cengage Learning; 25th edition (May 18, 2021)

Language : English

Hardcover : 992 pages

ISBN-10 : 0357519434

ISBN-13 : 978-0357519431

![]()

1、本站所有分享材料(数据、资料)均为网友上传,如有侵犯您的任何权利,请您第一时间通过微信(lib99net)、QQ(24661067)、电话(17898078618)联系本站,本站将在24小时内回复您的诉求!谢谢!

2、本站所有商品,除特殊说明外,均为(电子版)Ebook,请购买分享内容前请务必注意。特殊商品有说明实物的,按照说明为准。

![]()

![]()

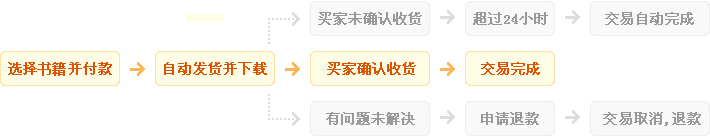

1、自动:在上方保障服务中标有自动发货的宝贝,拍下后,将会自动收到来自卖家的宝贝获取(下载)链接;

2、手动:未标有自动发货的的宝贝,拍下后,卖家会收到邮件、短信提醒,也可通过QQ或订单中的电话联系对方。

![]()

1、描述:书籍描述(含标题)与实际不一致的(例:描述PDF,实际为epub、缺页少页、版本不符等);

2、链接:部分图书会给出链接,直接链接到官网或者其他站点,以便于提示,如与给出不符等;

3、发货:手动发货书籍,在卖家未发货前,已申请退款的;

4、其他:如质量方面的硬性常规问题等。

注:经核实符合上述任一,均支持退款,但卖家予以积极解决问题则除外。交易中的商品,卖家无法对描述进行修改!

![]()

1、在未购买下前,双方在QQ上所商定的内容,亦可成为纠纷评判依据(商定与描述冲突时,商定为准);

2、在宝贝同时有网站演示与图片演示,且站演与图演不一致时,默认按图演作为纠纷评判依据(特别声明或有商定除外);

3、在没有"无任何正当退款依据"的前提下,写有"一旦售出,概不支持退款"等类似的声明,视为无效声明;

4、虽然交易产生纠纷的几率很小,但请尽量保留如聊天记录这样的重要信息,以防产生纠纷时便于网站工作人员介入快速处理。

人工在线查找书籍,不要问我们有什么,告诉我们您需要什么即可...¥1.00

人工在线查找书籍,不要问我们有什么,告诉我们您需要什么即可...¥1.00 【PPT】Linear Algebra and Its Applica...¥0.1

【PPT】Linear Algebra and Its Applica...¥0.1 Delay-Adaptive Linear Control by Ya...¥29.99

Delay-Adaptive Linear Control by Ya...¥29.99 Handbook of Organic Materials for E...¥19.99

Handbook of Organic Materials for E...¥19.99 FinFET Devices for VLSI Circuits an...¥29.99

FinFET Devices for VLSI Circuits an...¥29.99 Positron Beams and Their Applications¥29.99

Positron Beams and Their Applications¥29.99 ASM Handbook Volume 11A Analysis an...¥420.00

ASM Handbook Volume 11A Analysis an...¥420.00 PETSc for Partial Differential Equa...¥29.99

PETSc for Partial Differential Equa...¥29.99 无机非金属材料热工设备-作 者 : 姜洪舟主编 2015第5版...¥14.99

无机非金属材料热工设备-作 者 : 姜洪舟主编 2015第5版...¥14.99 Product and Process Design Principl...¥9.99

Product and Process Design Principl...¥9.99