Langer on Practical International Tax Planning provides current knowledge and expert advice attorneys need to help clients capitalize on ripe tax havens and financial centers.

Stocked with case studies that illustrate sound planning approaches, this book enables you to:

Select the right territories for each client

Deploy the right instruments within each territory to eliminate, reduce, or defer taxes

Avoid planning missteps that trigger tax problems

Use local contacts to open doors to tax havens

Respond effectively to changing tax planning situations in specific havens and financial centers

Regularly updated, Langer on Practical International Tax Planning gives you the latest word on the legal, tax, business, financial, social, political, technological, geographical, and regional factors to consider when developing and implementing customized planning strategies for clients. It is an invaluable tool for tax and estate planners, tax attorneys, accountants, and sophisticated investors.

Publication Date: June 2019

Last Updated: November 2021

ISBN: 9781402430046

Number of Volumes: 2

Table of Abbreviations

PART 1: U.S. Tax Rules that Affect Overseas Transactions of U.S. Persons

PART 2: Why Tax Havens Exist

Chapter 1: The Growth of Excessive Taxation

Chapter 2: Jurisdictional Bases for Taxation

PART 3: The Basics of International Tax Planning

Chapter 3: Determining the Source of Income

Chapter 4: Determining the Situs of Assets (Intangibles)

Chapter 5: Foreign Tax Credits

Chapter 6: Foreign Currency Transactions

Chapter 7: Transfer Pricing and Advance Pricing Agreements; and Appendix 7A

Chapter 8: Working with Tax Treaties; and Appendices 8A-8B

Chapter 9: Treaty-Based Return Positions

Chapter 10: Limitations on Treaty Shopping

PART 4: Tax Planning for Individuals

Chapter 11: How U.S. Citizenship Is Acquired

Chapter 12: Tax-Motivated Loss of Citizenship

Chapter 13: Visas Permitting U.S. Residence

Chapter 14: Residence Status for Tax Purposes

Chapter 15: Domicile and Its Impact on Taxes

Chapter 16: Estate Planning for Nondomiciled Aliens

Chapter 17: Mixed Marriages Between Citizens and Aliens; and Appendices 17A-17B

Chapter 18: Tax Benefits for Citizens Working Abroad

Chapter 19: Investments Abroad

PART 5: Using Companies

Chapter 20: Characterization of Entities for Tax Purposes

Chapter 21: Using Limited Liability Companies

PART 6: Using Trusts

Chapter 22: Who Can Use Offshore Trusts

Chapter 23: Changing the Situs of a Trust

Chapter 24: Emergency Trusts and Asset-Protection Trusts

PART 7: Secrecy, Disclosure, and Information Exchange

Chapter 25: Disclosure Requirements

Chapter 26: Tax and Information Returns

Chapter 27: What Governments Do with Your Information

Chapter 28: Information Exchange Between Countries; and Appendices 28A-28C

Chapter 29: Mutual Administrative Assistance in Tax Matters; and Appendices 29A-29B

PART 8: Tax Planning for Inbound Investments

Chapter 30: Foreign Investment in Bank Deposits

Chapter 31: Foreign Investment in Stocks and Bonds

Chapter 32: Foreign Investment in Real Estate

Chapter 33: Branch Profits Tax on Foreign Corporations

Chapter 34: Choosing Among Corporations, Partnerships, and LLCs

Chapter 35: Deducting Interest Paid to Related Parties

Chapter 36: Inbound Transactions: Withholding and Reporting

PART 9: Tax Planning for Outbound Activities

Chapter 37: U.S. Taxation of Foreign Corporation Operations

Chapter 38: Controlled Foreign Corporations

Chapter 39: Foreign Personal Holding Companies (FPHCs)

Chapter 40: Passive Foreign Investment Companies (PFICs)

![]()

1、本站所有分享材料(数据、资料)均为网友上传,如有侵犯您的任何权利,请您第一时间通过微信(lib99net)、QQ(24661067)、电话(17898078618)联系本站,本站将在24小时内回复您的诉求!谢谢!

2、本站所有商品,除特殊说明外,均为(电子版)Ebook,请购买分享内容前请务必注意。特殊商品有说明实物的,按照说明为准。

![]()

![]()

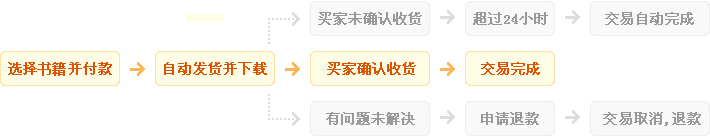

1、自动:在上方保障服务中标有自动发货的宝贝,拍下后,将会自动收到来自卖家的宝贝获取(下载)链接;

2、手动:未标有自动发货的的宝贝,拍下后,卖家会收到邮件、短信提醒,也可通过QQ或订单中的电话联系对方。

![]()

1、描述:书籍描述(含标题)与实际不一致的(例:描述PDF,实际为epub、缺页少页、版本不符等);

2、链接:部分图书会给出链接,直接链接到官网或者其他站点,以便于提示,如与给出不符等;

3、发货:手动发货书籍,在卖家未发货前,已申请退款的;

4、其他:如质量方面的硬性常规问题等。

注:经核实符合上述任一,均支持退款,但卖家予以积极解决问题则除外。交易中的商品,卖家无法对描述进行修改!

![]()

1、在未购买下前,双方在QQ上所商定的内容,亦可成为纠纷评判依据(商定与描述冲突时,商定为准);

2、在宝贝同时有网站演示与图片演示,且站演与图演不一致时,默认按图演作为纠纷评判依据(特别声明或有商定除外);

3、在没有"无任何正当退款依据"的前提下,写有"一旦售出,概不支持退款"等类似的声明,视为无效声明;

4、虽然交易产生纠纷的几率很小,但请尽量保留如聊天记录这样的重要信息,以防产生纠纷时便于网站工作人员介入快速处理。

人工在线查找书籍,不要问我们有什么,告诉我们您需要什么即可...¥1.00

人工在线查找书籍,不要问我们有什么,告诉我们您需要什么即可...¥1.00 【PPT】Linear Algebra and Its Applica...¥0.1

【PPT】Linear Algebra and Its Applica...¥0.1 Delay-Adaptive Linear Control by Ya...¥29.99

Delay-Adaptive Linear Control by Ya...¥29.99 Handbook of Organic Materials for E...¥19.99

Handbook of Organic Materials for E...¥19.99 FinFET Devices for VLSI Circuits an...¥29.99

FinFET Devices for VLSI Circuits an...¥29.99 Positron Beams and Their Applications¥29.99

Positron Beams and Their Applications¥29.99 ASM Handbook Volume 11A Analysis an...¥420.00

ASM Handbook Volume 11A Analysis an...¥420.00 PETSc for Partial Differential Equa...¥29.99

PETSc for Partial Differential Equa...¥29.99 无机非金属材料热工设备-作 者 : 姜洪舟主编 2015第5版...¥14.99

无机非金属材料热工设备-作 者 : 姜洪舟主编 2015第5版...¥14.99 Product and Process Design Principl...¥9.99

Product and Process Design Principl...¥9.99